As we enter the last quarter of the year, a question mark looms over whether consumer buying power will provide the expected boost during this traditional peak sales season. This uncertainty is due to the continuing impact of inflation and monetary tightening policies. On a positive note, the memory industry is showing signs of improvement, mainly due to production cuts by major suppliers aimed at rebuilding inventory. The emergence of generative AI and cloud computing applications remains a powerful force in accelerating the recovery of the memory market.

Entering the final quarter of 2023, let's delve into pricing updates and market forecasts for key applications in the memory market.

Market Overview

- Inventory reduction has not been reduced as expected, leading suppliers to continue production cuts.

- Suppliers are no longer willing to sell products at a loss, so we anticipate price increases on specific products.

- Despite lower prices, demand remains sluggish, with buyers prioritizing the optimization of existing inventory levels.

- We expect purchasing to resume when the market's inventory reaches a healthier level. The real actions of suppliers in terms of production cuts and market demand will be critical factors in stock adjustment.

Server Market

- Inflation has impacted overall demands. CSP operators have a need for high-capacity memory and HBM for AI server applications. However, the development of AI servers has not yet effectively reduced suppliers' existing inventory in sales.

- The demand for conventional servers will play a pivotal role in determining whether the market turns around in the near future.

- The percentage of suppliers' DDR5 inventory has increased from 20% in Q2 to 30%-35%. However, the penetration rate of DDR5 in servers in Q3'23 is only 15%, highlighting the importance of further DDR5 adoption in related applications.

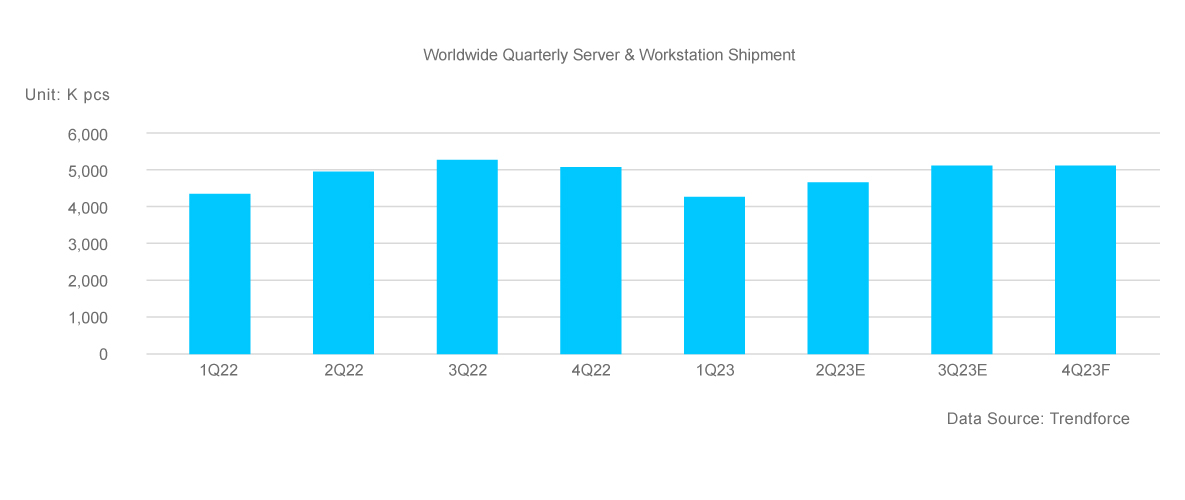

- Server shipments in Q4 are estimated to remain nearly the same as Q3, with a projected shipment of 4.9 million units.

PC/NB Market

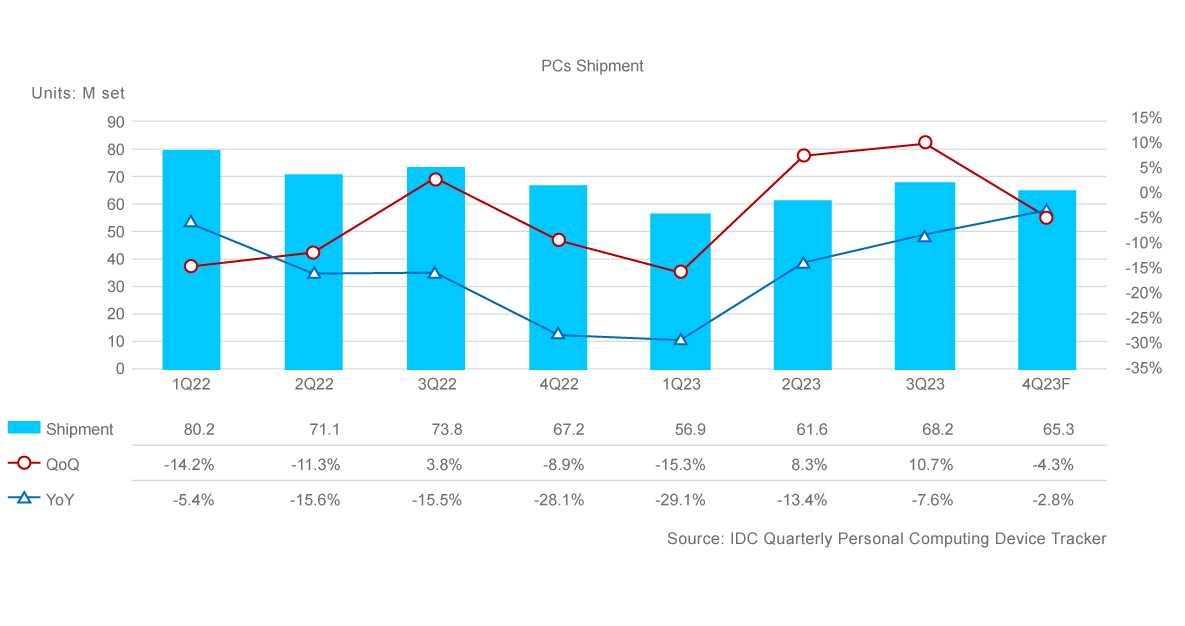

- PC shipments reached 68.2 million units in Q3, reflecting a 7.6% decline from the same quarter last year. However, this marks a 10.7% increase compared to the 61.6 million units shipped in Q2.

- Q4 traditionally represents the holiday season for sales, presenting a good opportunity to boost shipment momentum.

- Despite the slow pace of market recovery, the discontinuation of support and updates for Windows 10 will likely drive more sales in the second half of 2024 and beyond.

Q4 Outlook in DRAM

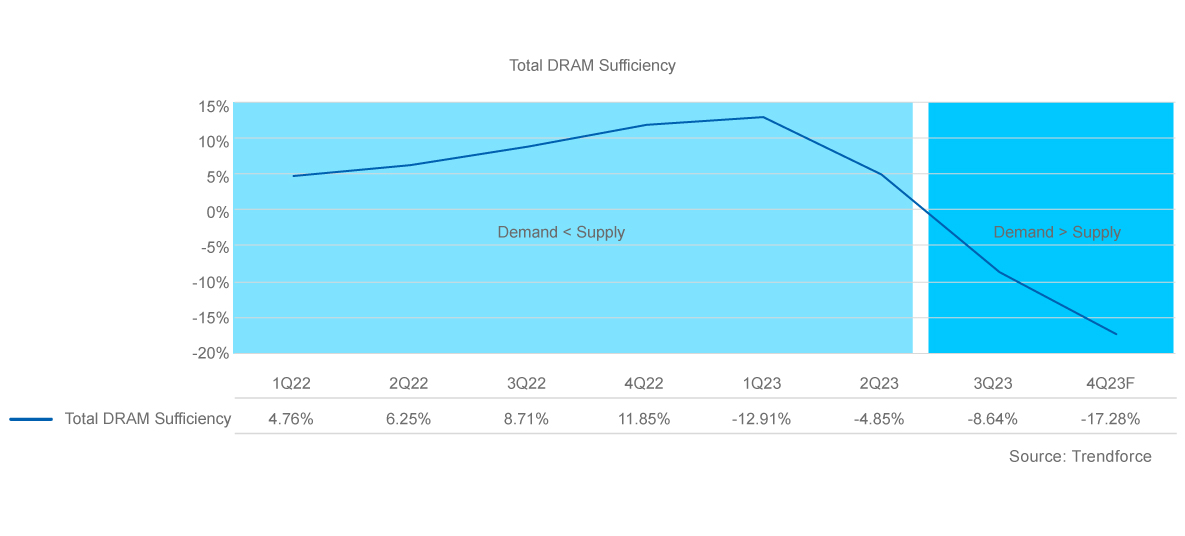

- As inventory level optimization continues and the effects of suppliers' planned production cuts take hold, the sufficiency ratio for Q4 is estimated to reach -17.28%.

- The top three DRAM suppliers have increased some of their product quotes to safeguard their profits.

- The overall DRAM average selling price (ASP) is expected to grow by 3%-8% on a quarter-over-quarter basis.

Q4 Outlook in NAND Flash

- Samsung is planning to reduce NAND Flash capacity utilization even further, targeting nearly 50% in Q4. This may influence other suppliers to implement additional production reductions.

- Consequently, the sufficiency ratio for NAND Flash is estimated to reach -28.5%.

- In a scenario where demand outpaces supply, the overall NAND Flash average selling price (ASP) is expected to increase by 8%-13%.

*The article was compiled by SMART Modular using data source from market reports by DRAMexchange, Trendforce, IDC, and DIGITIMES.